The UAE’s tax system has evolved quickly over the past few years. With VAT and Corporate Tax now firmly part of the business landscape, the focus has shifted from simply filing returns to managing tax payments more strategically. One of the newer features supporting this shift is the advance tax payment option in EmaraTax. This facility allows businesses to pay tax before filing their return, helping them avoid last-minute stress, penalties, and cash-flow disruptions. If you’re not yet using it, this guide explains how it works and why it can be a smart compliance strategy.

Businesses registered with the Federal Tax Authority are required to file returns and pay taxes within strict deadlines. Missing deadlines can lead to penalties, which can accumulate quickly and affect financial planning.

To make tax management easier and more flexible, the FTA introduced the advance payment facility through EmaraTax, the UAE’s official tax platform.

Simply put, this feature gives businesses the ability to pay tax early and keep funds ready inside their FTA account until the next return is filed. In practical terms, businesses can make voluntary early tax payments to avoid delays, penalties, or last-minute payment risks.

What Is Advance Tax Payment?

An advance tax payment is a voluntary payment made before filing your next tax return. Instead of waiting until the due date, businesses can deposit funds into their FTA account in advance.

These funds are not lost or locked — they are held securely and automatically used when your next return is submitted.

Key Purpose of Advance Payments

Advance tax payments are designed to:

- Improve compliance and reduce payment risks

- Support better cash-flow planning

- Reduce the chance of late payment penalties

- Provide a financial buffer before filing deadlines

Once the return is filed, the advance payment is automatically adjusted against the liability. Any remaining balance is carried forward and applied to future dues.

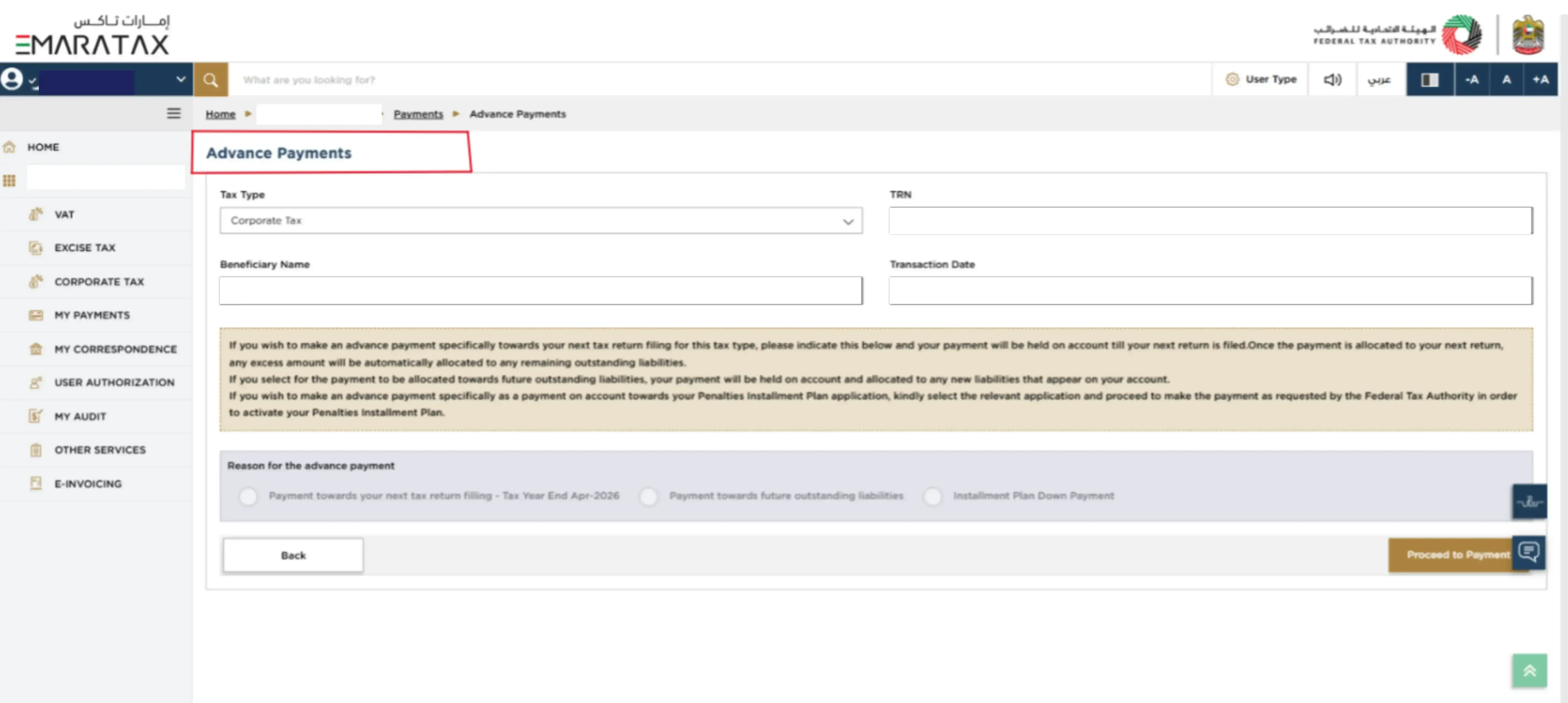

Where to Find the Advance Payment Option in EmaraTax

Inside EmaraTax, the process is straightforward:

Path:

EmaraTax → My Payments → Advance Payment

This section allows businesses to deposit funds into their FTA account even before a tax liability is formally generated.

How Advance Payment Allocation Works

Understanding allocation is important so businesses know exactly how their money will be used.

When you make an advance payment:

- The payment is held in your FTA account.

- Once the next tax return is filed, the system automatically applies the payment.

- If there is any excess amount, it will be applied to:

- Future tax liabilities

- Outstanding liabilities (starting from the oldest due amount)

The FTA clarifies that advance payments are applied to the immediate next return first, and any remaining balance is used for other dues.

This automated allocation removes the need for manual adjustments.

Types of Advance Payment Options Available

EmaraTax offers structured payment choices depending on your needs.

1) Payment Towards the Next Tax Return

This option reserves funds specifically for the immediate upcoming filing period.

It is useful when:

- You already know your upcoming tax exposure

- You want to set aside funds early

2) Payment Towards Future Liabilities

Funds are automatically used for future tax dues once they arise.

This option is ideal for:

- Businesses with consistent tax obligations

- Companies wanting to maintain a tax reserve

3) Instalment Plan Down Payment (When Applicable)

If a business has an approved penalty instalment plan, advance payments can be used as the down payment.

This helps businesses:

- Manage penalties in structured instalments

- Reduce financial pressure

Together, these options allow businesses to plan payments proactively instead of reacting to deadlines.

Example: How It Works in a Monthly Tax Period

Let’s simplify this with a practical example.

Imagine your December return is already filed.

If you now make an advance payment:

- The payment cannot be applied to December.

- Instead, it will automatically apply to the January period.

If you still owe tax for December, you must use the “Select and Pay” option to settle that liability.

This is an important rule:

Advance payments apply only to future returns, not already filed returns.

Advance Payments via GIBAN

Businesses making payments through bank transfer must follow one key step.

Before transferring funds, you must generate a unique payment reference number.

Why this matters:

- Ensures correct allocation of the payment

- Prevents delays or misapplied payments

- Required by the FTA for GIBAN transfers

Skipping this step can result in payment processing issues.

Is Advance Tax Payment Mandatory?

No advance tax payment is not mandatory in the UAE. However, it is strongly recommended as a risk-management and compliance tool. Even if advance payment is made, businesses must still ensure the full tax liability is paid by the official deadline.

Think of it as preparation, not replacement.

Benefits of Making Advance Tax Payments

Businesses that use this feature gain several advantages.

- Avoid Late Payment Penalties: Having funds ready inside the FTA account reduces the risk of missing deadlines.

- Reduce Last-Minute Banking Risks: Payment delays can happen due to:

- Banking cut-off times

- Technical portal issues

- Approval delays

- Advance payments eliminate these risks.

- Improve Financial Planning: Setting aside tax funds early improves:

- Cash-flow forecasting

- Budget discipline

- Financial stability

- Strengthen Compliance Management: Businesses can shift from reactive compliance to proactive tax planning.

Conclusion

Advance tax payment in EmaraTax is more than just a feature it is a smart way to manage your taxes. Paying early helps businesses lower risks, avoid penalties, manage cash flow better, and stay organized with tax deadlines. When used properly, advance payments make tax time less stressful and more predictable. Getting support from experts like Reyson Badger can make the process even easier. They can help you plan payments correctly and make sure your business stays fully compliant with UAE tax rules.

The Federal Tax Authority (FTA) has announced that businesses must complete Corporate Tax registration within 90 days from the Date of Incorporation / MOA.

The Federal Tax Authority (FTA) has announced that businesses must complete Corporate Tax registration within 90 days from the Date of Incorporation / MOA.